- December 19, 2024

The IRS 1099-INT Form is an Internal Revenue Service tax Form that reports the interest income. For all those who ask what the 1099-INT form is, this blog will be of great help. Form 1099-INT is issued by all the entities that pay the interest income to the investors during the tax year. The tax Form will include a breakdown of all the types of interest income and the related expenses. The IRS Tax Form 1099-INT is issued by interest-paying entities, such as investment firms, banks, taxpayers, and other financial institutions that receive interest income of $10 or more. The information recorded on the Form should be reported to the IRS, and other 1099 INT instructions are discussed here.

Table of Contents

Who can file the IRS Form 1099- INT Interest Income?

The amounts paid to the taxpayers and to be reported on a 1099-INT include interest on bank deposits, accumulated dividends paid by a life insurance company, and indebtedness issued in the registered Form or of a type offered to the public, such as notes, bonds, debentures, and certificates other than those of the U.S. Treasury. Amounts from which the federal income tax or foreign tax was withheld. Less common amounts that are recorded on the Form 1099-INT include,

- Interest accrued by a real estate mortgage investment conduit.

- Amounts paid to a collateralized debt obligation holder.

- Financial asset securitization investment trusts regular interest holders.

IRS 1099-INT Form for Payers

The interest income is any amount that is paid by the banks, mutual fund companies, investment houses, and financial institutions to the account holders, who deposit money into savings accounts, investments, and other interest-paying ventures. Form 1099-INT should be filed for,

- Each person who receives at least $10 or at least $600 of interest paid in the course of your trade or business.

- When financial institutions pay foreign taxes on interest,

- When a financial institution withholds and doesn’t refund the Federal income tax under the backup withholding rules, without any regard for how much is paid.

The interest paid is considered to be taxable income and should be reported to the IRS on the annual tax returns every year it’s earned. The interest-paying entity should file a 1099-INT on any interest over $10 paid during the year. Taxpayers who receive over $1500 of taxable interest must list all the payers on Part 1 of Schedule B on the tax Form 1040. Form 1099-INT will always report the interest paid as the cash basis income.

1099-INT Form for Recipients

Taxpayers who receive Form 1099-INT will be required to report certain income on their Federal tax returns. The taxable interest will be taxed at the same rate as ordinary income, at the same rate as salary and wages, and the individual. This also excludes tax-exempt income or income that is exempt at various tax reporting levels. Most interest income is also reported on Part 1 of Schedule B, Interest and Ordinary Dividends. The taxpayer should list their taxable income as part of a list of all the forms of taxable interest.

How to file 1099-INT Form: Instructions for the 2024-25 Tax Year

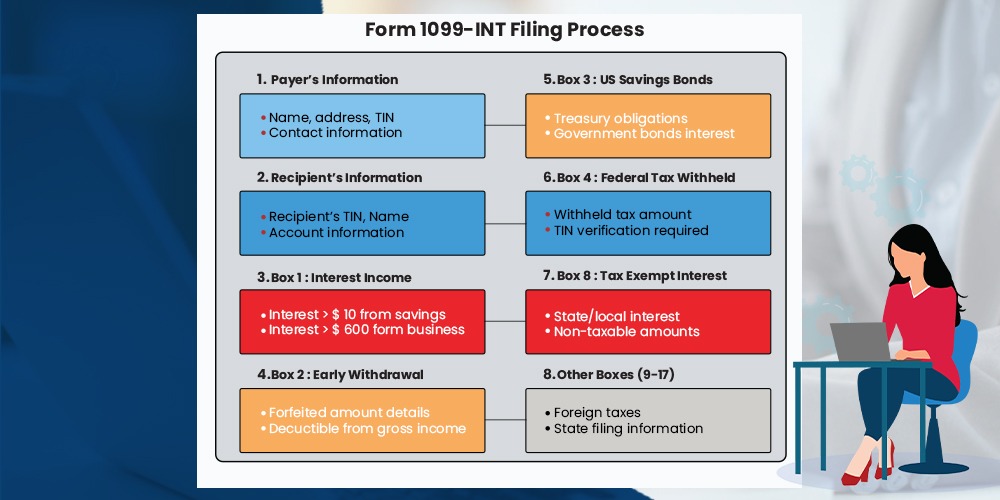

Form 1099-INT is used to remit the information that relates to the amount of interest that is paid or received during the tax year. All the sections of the IRS Form 1099-INT need not be filled out. Only the relevant information that pertains to the specific taxpayer should be completed. Other 1099 INT instructions are as follows.

Payer’s Information

The IRS Form 1099- INT should include the payer’s name, street address, city, state, country, ZIP code, and telephone number. The payers are also required to report their TIN on the Form.

Recipient’s Information

This section includes the recipient’s TIN, name, city, street address, country, and ZIP code. If multiple accounts are to receive a different 1099-INT Form, the issuing party should list the individual’s account number. Some lending institutions should aggregate the Forms.

Box 1: Interest Income

Box 1 of Form 1099-INT reports the taxable amount of interest. This amount will not include the amounts that are reported on Box 3. This box includes the amounts of $10 or greater paid to the savings account of the individual, the bank deposits, the dividends that a life insurance company pays, and other types of interest. This box will include the interest of $600 or more in the course of the trade or business.

Box 2: Early Withdrawal Penalty

Box 2 of Form 1099-INT reports the amount of principal or interest that is forfeited because of an early withdrawal of funds. The amount reported on box 1 of this form is not reduced by the forfeiture deductible, and the forfeiture is also deductible from the recipient’s gross income.

Box 3: Interest paid on the US Savings Bonds and the Treasure Obligations

Box 3 of the 1099-INT tax Form reports the amount of interest that is earned on the U.S. savings bonds, treasury notes, treasury bills, and treasury bonds that the U.S. issues. Government. This interest will not be included in the amount of interest that is earned and reported on Box 1 on the Form.

Box 4: Federal Income Tax Withheld

Box 4 of this tax Form will report the amount of taxes withheld from the interest payments. If the taxpayer doesn’t promptly provide their TIN upon request, a portion of the interest earned must be withheld from their payments. The IRS will offer guidance on requesting the recipient’s TIN as part of the tax Form instructions.

Box 8: Tax Exempt Interest

Box 8 is also commonly used while filing Form 1099-INT. This Box will report the amount of tax-exempt interest. This type of interest is most often earned off the obligations, that are issued by the state or order governmental entity. This amount is not taxable and is not to be included in the gross income of the taxpayer.

Other Boxes in the Tax Form

Form 1099 has in total of 17 boxes. Many of these boxes are for very specific purposes. The other areas of this tax Form will cover foreign taxes, market discounts, activity bond interest, and more tax-exempt investments. Boxes 15, 16, and 17 are also used by the taxpayers who will participate in the combined Federal and State Filing program to offer the state tax information.

Special Considerations While Filing Out Form 1099- INT

Some types of taxpayers and entities are not required to receive Form 1099- INT even if they receive the interest payments. This list of exempt entities will include tax-exempt organizations, corporations, certain health accounts, U.S. agencies, and other payees. Also, Form 1099- INT is not just used for interest issued by an individual inside the United States, that is paid inside the United States.

The IRS 1099-INT Form is used for interest payments, but there are conditions on when the interest is actually paid. In general, interest is paid when it is credited to the taxpayer, without any substantial restrictions and limits. The interest should also be made available so that the taxpayer can withdraw it at any time.

Who Should File Form 1099- INT

Form 1099- INT should be filed by any entity that pays the interest such as investment firms, banks, brokerages, mutual funds, and other financial institutions. It is required to file the Form to anyone who receives an interest income of at least $10, when they withhold and pay the foreign taxes on interest, and whenever the issuer of the Form withholds Federal income tax, without having to refund it. One copy of this tax Form will be sent to the IRS, and copy B of the tax Form will be sent to the taxpayer.

When Will a Person Receive Form 1099- INT

Interest-paying entities should submit Form 1099- INT by 31 January. Anyone who doesn’t receive this tax Form should contact the issuer to get another copy. Many lending institutions can offer the 1099-INT Form as a downloadable.

1099-INT Form often reports taxable income earned during the year. This information will be remitted to the IRS and should be included as ordinary income on the tax return. Disregarding this tax-exempt income, taxpayers will be required to report the contents of Form 1099-INT on their Federal tax returns.

Taxpayers who earn more than $10 of interest from their bank account savings will receive Form 1099-INT. Lending institutions will be required to issue the Form to account holders who earn this threshold. There are many other situations in which the taxpayer might have received Form 1099-INT, all of which relate to the interest that has been paid to the taxpayer.

Filing IRS 1099-INT Form: Key Information and How Tax2efile Can Help

The IRS Tax Form 1099- INT will be used to remit tax information related to the amount of interest paid and received. Payers must meet certain thresholds and conditions before issuing Form 1099-INT, which often means that the taxpayer has taxable interest income, which should be reported on the Federal tax return. Taxpayers can get help from experts at Tax2efile to file their 1099-INT on time, without any errors, so as to avoid returns and late filing penalties from the IRS.