- December 5, 2024

IRS Tax Form 1099-G is a tax form that reports the income received from the Department of Revenue during the calendar year. The Internal Revenue Service requires government agencies to report certain payments during the tax year to the IRS because these payments will be considered gross income to the recipient. The department will report refunds and overpayment credit amounts that are issued during the year to individuals who have claimed itemized deductions on the Federal income tax return.

Table of Contents

What is IRS Form 1099-G?

Federal, state, and local governments have issued taxpayers Form 1099-G for certain types of government payments. Though there are a handful of purposes for this Form, it is generally common for two types of payments: unemployment compensation and state or local income tax refunds, offsets, and credits. Regardless of the type of payment, it might be required to include some of the information from this tax Form on the return. The payment may or may not be taxable, depending on the specific situation.

Form 1099-G for Unemployment Compensation

If the citizen draws unemployment income from the state government, then the unemployment benefits are subject to taxes. The amount of the benefits will be shown in Box 1 on the tax Form 1099-G. If they have chosen to pay the taxes withheld from the benefits, then this amount will appear on Box 4.

- Box 1 of the 1099-G Form will show the total unemployment compensation payments for the tax year.

- Schedule 1 of the tax Form 1040 will include a separate line for unemployment compensation in the total income section.

- It may not be required to attach the 1099-G to the tax return.

Form 1099-G for State Tax Refunds, Offsets, and Credits

If the state issues a refund, credit, or offset of the state of the local income, then the amount will be shown on Box 2 of the 1099-G Form. The most common reason for receiving a refund is because of an overpayment of state taxes. This payment may or may not be taxable for the taxpayer. If the taxpayer claims that standard deduction on their previous year’s return, then the amount is not taxable for the taxpayer.

However, if the taxpayer claimed itemized deductions on the previous year’s return, all or even part of the refund is taxable in the year in which it is received if they have deducted state and local income taxes and received a tax benefit for deducting them.

Other payments covered by Form 1099-G

The other reasons why taxpayers receive from the IRS tax Form 1099-G will include the following types of payments.

- Re-employment trade adjustment assistance payments, which will be shown on Box 5 of the Tax Form.

- Taxable grants that are received from the Federal, state, and local governments, and this income will be shown on Box 6 of the tax Form.

- The taxable payments from the Department of Agriculture and this amount will be reported in Box 7 of the tax form.

- Market gains on the commodity credit corporation loans. This income will be shown on Box 9 of the Tax Form.

Who has to File Form 1099-G?

In the IRS tax Form 1099-G, certain Government payments will be filed by different government levels, including the state, local, and the Federal government. This tax Form should be filed under the following conditions,

- When the citizen receives unemployment compensation.

- When they receive agricultural payments from the government.

- When they receive income tax refunds, credits, and other offsets at the local and state levels.

- When the government offers reemployment trade adjustment assistance.

- If the citizen receives taxable grants.

It is also required that the Federal, State, or Local governments file Form 1099-G to report whether they have received payments on the Commodity Credit Cooperation loan. It is required to complete five copies of the Form 1099-G. The IRS will receive Copy A of the 1099-G Form. The state tax department will get Copy 1 of the Form. The taxpayer will get copy B and Copy 2 goes to the taxpayer to file with their state income tax return if required. Copy C of the tax Form will to the payer of the filing agency.

How to File Form 1099-G?

The IRS Form 1099-G will be sent to the taxpayer if the Federal, State, and local government has made payments to the taxpayer. The most common uses of the 1099-G are to report unemployment compensation and state and local income tax refunds. If you receive a 1099-G, you will need to report some of the information when the taxpayer files their income tax return. This information will be included as part of the income on Form 1040.

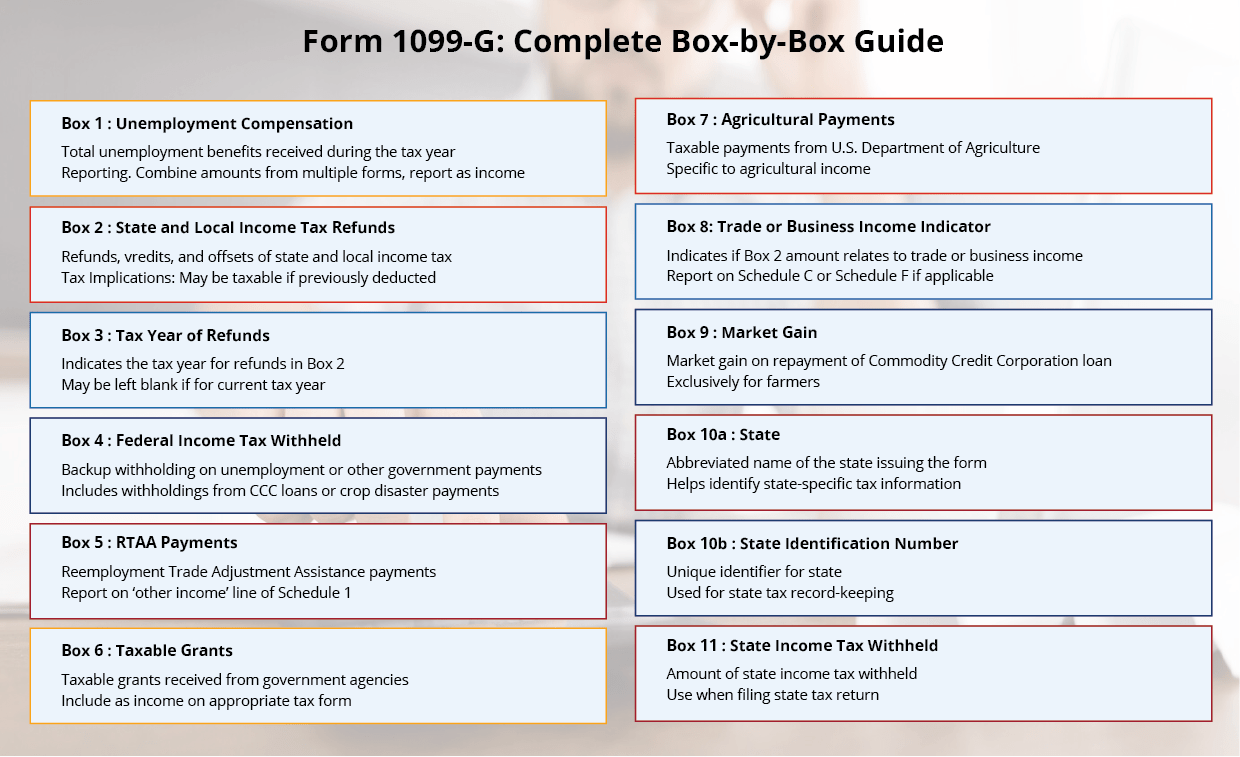

The taxpayer should receive Form 1099-G by 31st January of the year, following the tax year. The taxpayer will also be able to access the Form online if they receive unemployment compensation by visiting the state’s unemployment benefits website. The left side of the Form includes details about the payer and the recipient, which includes the names, addresses, tax identification numbers, and other associated account numbers. The 1099-G Form will have in total of eleven boxes and the details are as follows.

Box 1: Reports Unemployment Compensation

This box is reserved for the total unemployment compensation received this year. If the taxpayer receives more than one 1099-G, they should combine the amounts in Box 1 and report the total as income on the unemployment compensation line of the tax return.

Box 2: State and Local Income Tax Credits, Tax Refunds, and Offsets

Box 2 of the tax Form will show the refunds, credits, and offsets of the state and local income tax that the taxpayer receives. This amount might be taxable if they deduct the local or the state income tax paid on Schedule A of the tax Form.

Box 3: Box 2 Amount is for the Tax Year

Box 3 will show the tax year for which the refunds, offsets, or credits in Box 2 are made. The box may be left blank if the credit, refund, or offset is set for the current tax year.

Box 4: Federal Income Tax Withheld

Box 4 of Form 1099-G will show the backup withholding or the withholding that they have requested on unemployment compensation, CCC (Commodity Credit Corporation) loans or other certain crop disaster payments.

Box 5: RTAA Payments

Box 5 shows the reemployment trade adjustment assistance payments that they have received. This amount is generally included on the ‘other income’ line of Schedule 1 of the tax Form.

Box 6: Taxable Grants

This box shows taxable grants that the taxpayer receives from government agencies.

Box 7: Agricultural payments

Box 7 shows the taxable payments that they have received from the U.S. Department of Agriculture.

Box 8: Check if Box 2 is For Trade or Business Income

Box 8 shows if the amount in Box 2 is related to the income tax that applies exclusively to the income from a trade or business. If this is taxable, the amount from Box 2 should be reported on Schedule C or Schedule F.

Box 9: Market Gain

Box 9 shows the market gain associated with the repayment of a commodity credit corporation loan that is available only to farmers.

Box 10a: State

Box 10a displays the abbreviated name of the state.

Box 10b: State identification number

Box 11 of the tax Form will show the amount of the state income tax withheld.

What is Form 1099-G Used For?

The IRS tax Form 1099-G reports payments made by government entities to taxpayers, including unemployment compensation, state and local income tax refunds, reemployment trade adjustment assistants, agricultural payments, and taxable grants. The Form is also used to report the payments that the farmers receive for the commodity credit corporation loans.

When will the taxpayer receive Form 1099-G?

The local, state, and federal governments, along with the other government agencies, will send the taxpayers the Form 1099-G the year after the payments are made or after they have received, in the case of a CCC loan, by 31st January. Taxpayers can also log on to the website of the agency to get a copy of their tax Form online.

Being Aware of the 1099-G Unemployment Fraud

During the pandemic, the federal and state governments increased the number of workers eligible for unemployment insurance benefits and the amount of those benefits in response to the pandemic. Unfortunately, unemployment fraud has increased as well, with organized groups using stolen data to steal identities and submit fraudulent unemployment insurance benefit claims.

With IRS-authorized service providers like Tax2efile, all the unemployment frauds surrounding IRS Form 1099-G can be eliminated. Tax2efile will allot a tax expert to match the unique situation with respect to the 1099-G taxes and will offer unlimited and