- August 7, 2025

Get ready for some changes! In 2025, the IRS is introducing a new billing system called One Big Beautiful Bill (OBBB). The goal is to simplify things and make your tax experience less confusing. This new system takes effect on July 4, 2025, and it will impact everyone filing taxes that year and in subsequent years.

Table of Contents

What is One Big Beautiful Bill?

Essentially, it’s the IRS’s way of responding to calls for clearer tax communication. Before, you might have gotten a bunch of separate bills and notices, which could be confusing. The OBBB is meant to replace all of that with one easy-to-read statement. Think of it as a single bill that shows everything you owe, all your payments, and any past-due amounts. The features that you can expect in OBBB are.

- One Bill: Instead of multiple notices, you’ll get one statement with all your federal tax stuff on it (like income tax, self-employment tax, and any penalties).

- Clear Details: The bill will break down exactly what you owe, line by line.

- QR Codes for Payments: You’ll be able to pay your taxes easily online using QR codes on the bill.

- Installment Plan Info: If you’re on a payment plan, the OBBB will show your payment schedule and how much you still owe.

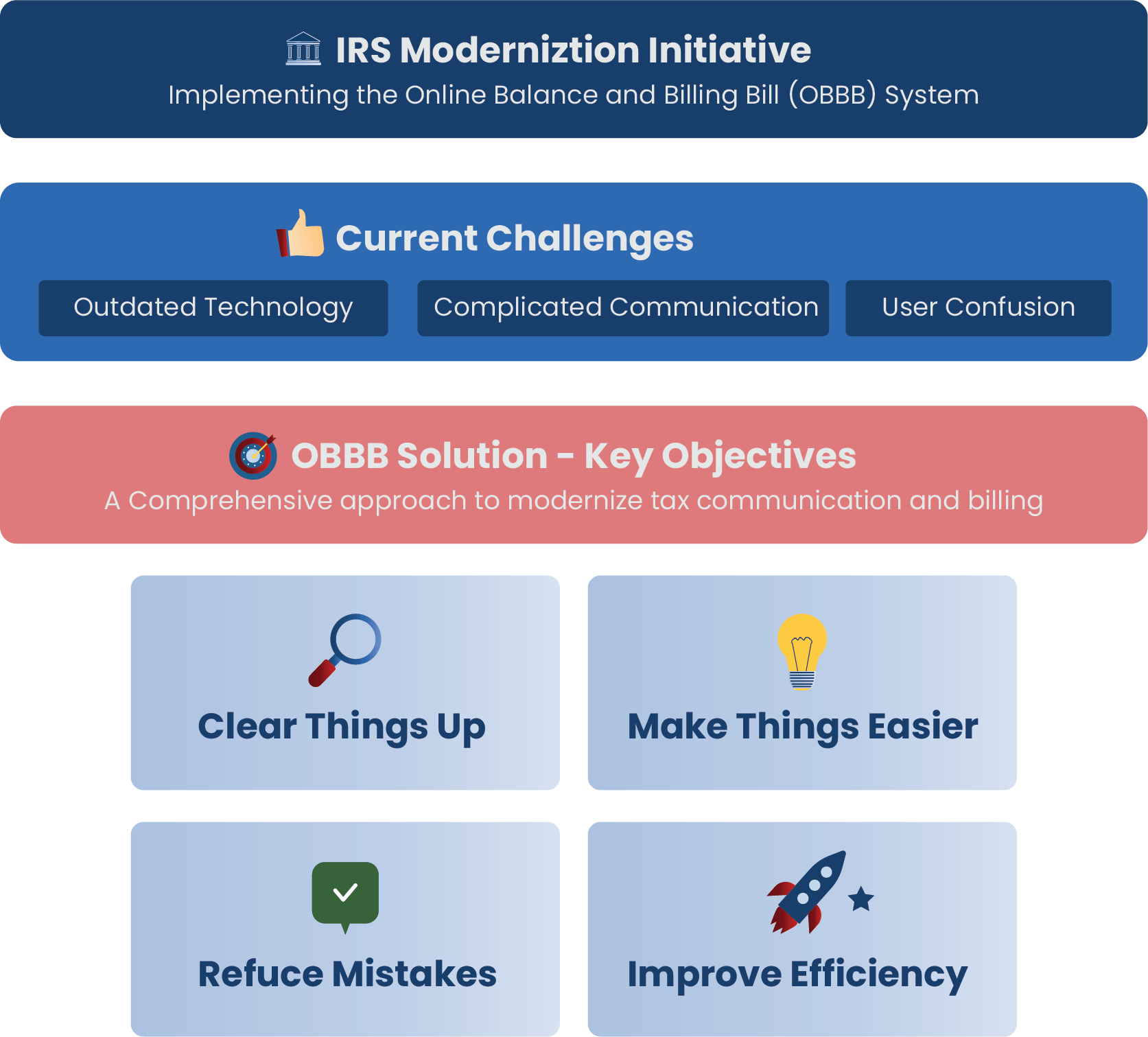

Why is the IRS Implementing this?

These tax changes are part of a bigger plan to improve the IRS. They know they have outdated tech and complicated ways of talking to people. The OBBB is supposed to fix some of those problems by being more user-friendly. The main objectives of this endeavor are.

- Clear Things Up: Give taxpayers a clear picture of their tax situation so they don’t get confused.

- Make Things Easier: Simplify the info, so it’s easier to understand and act.

- Reduce Mistakes: By making the billing process easier, the IRS hopes to cut down on late payments and other errors.

- Improve Efficiency: By automating some billing tasks, the IRS can free up its people to focus on other important tasks.

What OBBB Means for People Filing in 2025

The OBBB is supposed to make tax stuff easier for everyone. By giving you a single, clear view of your finances, it can help avoid confusion, which often leads to penalties or missed payments. Here’s the breakdown for various segments that can be anticipated through digital payments.

W-2 Employees

If you’re a regular employee, you’ll probably find this change helpful. If you usually get a refund or a little, this will give you a clearer summary of your tax situation. Plus, it provides clear payment instructions and a single spot to see any outstanding balances. The OBBB also has some new, temporary deductions (until 2028) for overtime pay (up to $12,500 if you’re single and $25,000 if you’re married) and qualified tips (also up to $25,000). This could lower the tax bill for many workers since people who work more hours now have service jobs.

Self-Employed Folks

This group often deals with self-employment tax and estimated taxes. The OBBB should give you some much-needed clarity by combining everything into one statement. This can make it easier to see your overall tax situation and plan your payments. Self-employed people can use the tip deduction, too, which could mean some tax savings.

Low-Income Families

The OBBB’s clarity can be helpful for low-income families, especially those who use programs like the Earned Income Tax Credit (EITC) or Child Tax Credit. An easy-to-understand bill can help them see what they owe or what refund they can expect. The Child Tax Credit is also getting a boost, going up to $2,200 per kid (from $2,000 in 2025).

How to Acquire Your OBBB

The IRS is sticking with mail but also going digital. You’ll still get a paper bill in the mail. You can also access your OBBB online through your IRS account to see your bill, payment history, and other tax info. If you don’t have an account, now’s a good time to set one up. Many tax software programs will also connect with the OBBB system, so you can see and manage your bill in the program you like to use.

Key Benefits

The OBBB consolidates your complete tax data into a single hub, so you can see everything easily. Making payment plans easier because all the info is clear. You’ll know exactly what you’re unsettled and when it’s due. We can help taxpayers spot discrepancies and start a dispute with the IRS if needed. Gives taxpayers a detailed record related to their tax filings, which can help with record-keeping.

Things to Keep in Mind

While the OBBB is meant to make things easier, there are a few things to watch out for:

Scams: Any time the IRS makes a big change, scammers try to take advantage of it. Be careful of emails, texts, or calls that say they’re from the IRS and ask for info about your One Big Beautiful Bill. Always double-check by going to the IRS website.

Penalties Apply: Just because the bill is simpler doesn’t mean you get a free pass! You’ll still have outstanding penalties and interest if you don’t pay your taxes. The OBBB is just meant to make it easier to understand what you owe and pay it.

Possible Mistakes: With any new system, there could be some initial problems. Double-check your OBBB carefully and don’t be afraid to ask the IRS if something doesn’t look right.

How to Get Ready for 2025 Filing with Tax2efile

To get ready for the 2025 tax season, here are a few things you can do. A good idea is to use a web application like Tax2efile. They stay up to date on all the latest IRS changes, including the OBBB. These programs can help you understand your tax situation and file your taxes.

- Make sure your IRS account is up to date. If you don’t have one, sign up at IRS.gov.

- Check that your mailing address and online account info are correct, so you get your OBBB and other important notices.

- Keep your old tax returns and payment records, just in case.

- If you’re not sure how the OBBB will affect you, talk to a tax expert through tax2efile. They can answer your questions and help you understand your bill.

- Don’t wait until the last minute. The OBBB is supposed to help you keep track of your taxes throughout the year.

The One Big Beautiful Bill is a step toward a more open and user-friendly tax system. Through combining information, improving communication, and using tech, the IRS hopes to make taxes less confusing. While it’s always a good idea to watch out for scams and initial glitches, the OBBB should make it easier for people to understand and pay their taxes. So, get ready for this change and have a beautiful tax season with the tax2efile web application.