- September 24, 2025

The IRS said on August 25, 2025, that interest rates aren’t changing for the last three months of 2025 (October 1 to December 31). This is important news for taxpayers because it affects how much interest you pay on taxes you owe and how much you get back on refunds.

Table of Contents

How Interest Rates Break Down for Q4 2025

The IRS sets these rates every three months based on the federal short-term rate. The rates for both overpayments and underpayments for individuals remain the same for the whole three months. Businesses have different rates.

For individuals, the rate is 7% per year, figured daily, for both overpayments and underpayments. Even though it’s not changing, this rate still matters if you owe money or expect a refund.

The IRS released the news and said that these rates are steady for the fourth three-month stretch, showing a stable financial picture.

Here’s a quick peek at the rates for Q4 2025:

What IRS Interest Rates Mean for Taxpayers

Even though the rates are the same, they still matter because of how interest is figured daily. Here’s what you should keep in mind:

- If You Owe Taxes (Underpayments): Interest starts adding up from the original due date of your return (or the extended date, if you got one). Even though rates are set every three months, owing for longer than that means the total interest could change. Eventually, with the rate at 7%, this could make your debt a lot bigger.

- If You Get a Refund (Overpayments): The same idea goes if the IRS owes you money. Interest on your overpaid taxes starts either when you filed or the day after the tax return was due. While a refund with interest is nice, it’s not a great way to save money. It’s usually better to adjust your payments or withholdings so you don’t overpay in the first place, letting you use that money all year.

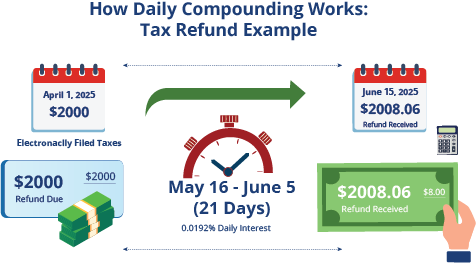

Example: How Daily Compounding Works

Let’s look at a sample scenario of how that 7% daily rate works:

- Rela filed her 2024 taxes electronically on April 1, 2025, and was due a $2000 refund.

- Because the IRS was slow, she didn’t get her refund until June 15, 2025.

- The IRS paid her interest from May 16 to June 5 (21 days) because it took longer than 45 days.

- Interest is figured at 7% per year, which is about 0.0192% per day. So, Rela got an extra $8.06 ($2000 \* 0.0192% \* 21 days = $8.06). It’s not much, but it can add up with bigger refunds or longer waits.

- Now, imagine if Rela owed the IRS and paid late –she’d be paying that interest instead.

How Tax2efile Helps You Stay on Top of Things

Filing and paying your taxes on time and correctly helps avoid interest charges or ensures you get a refund. A user-friendly app like Tax2efile can be helpful. Tax2efile is an IRS-approved e-filing service designed to make taxes quick, secure, and easy. It’s a tool to deal with your taxes, whether you’re an individual or a business, especially since IRS interest rates are steady and you can file from anywhere and do multiple forms easily.

Better Estimates to Avoid Mistakes: Tax2efile walks you through each step of the tax process with a simple layout. It helps you pick the right credits and deductions, making sure your tax amount is correct from the start. This lowers the chance of owing more later and having to pay interest.

Easy E-filing and Payments: Instead of mailing a paper return, you can file electronically, which is easier and more reliable. The system also lets you pay any taxes you owe right away. Tax2efile makes sure your payments are sent on time by linking to your bank account, lowering the risk of late fees and interest.

Quick Refunds: Tax2efile helps get your refunds faster. Our smart e-filing platform enables you to get your money quickly and cuts down the long waiting period.

When you’re filing taxes, think about using a platform like Tax2efile to stay confident and compliant. With these interest rates staying the same for Q4 2025, remember that unpaid taxes can add up fast, late filing or mistakes can cost you extra, and while overpayments earn interest, Tax2efile helps you get your refund right away.