- October 3, 2025

The trucking industry plays a major role in the logistics of the United States. Millions of trucks move goods across the states each year, making sure that shelves are full and supply chains are strong. But there is a big responsibility involved behind the wheel- not only to the driver but also to the business that owns the fleet. Fleet Insurance is one of the most important elements of the protection of this sphere.

In 2025, fleet insurance is essential for protecting your business assets, regardless of business size. Here is a guide we will discuss fleet insurance, why it is important to truckers, the types of coverage offered, future trends in the field of the year 2025, and how it relates to business compliance, such as taxes.

The global fleet insurance market is experiencing growth, with a projected value to exceed $147.89 billion by 2032, growing at a CAGR of 7.5% from 2025

Table of Contents

What is Fleet Insurance?

Fleet insurance is a policy that helps businesses insure multiple vehicles under a single policy. Instead of getting insurance for each vehicle separately, a trucking business can buy one policy that covers all its trucks, which facilitates easy management and minimizes the overall cost.

For truckers, fleet insurance guarantees every truck on the roads is covered against threats such as accidents, theft, damage, and liability claims.

Essential Fleet Insurance Coverage Types

A comprehensive Fleet Insurance policy is a combination of several specialized coverages. Understanding each component is crucial for building a policy that protects your assets and satisfies federal and state mandates.

| Coverage Type | What It Protects | Regulatory Requirement |

|---|---|---|

| Primary Auto Liability | Bodily injury or property damage to others in an accident you cause. | Mandatory for interstate carriers (federal filings) and intrastate carriers (state filings). |

| Physical Damage | Pay for repair or replacement of your trucks and trailers due to collision, fire, theft, or vandalism. | Required if vehicles are financed or leased but highly recommended for all. |

| Motor Truck Cargo | The freight you are hauling, covering loss or damage to the goods themselves. | Required by law and/or most shippers/brokers. |

| General Liability | Non-trucking-related risks, such as a slip-and-fall at your terminal or office. | Recommended, often required by contracts. |

| Non-Trucking Liability (Bobtail) | Personal use of a truck when it is not under dispatch and not hauling a load. | Essential for owner-operators leased to a motor carrier. |

| Workers’ Compensation | Medical costs and lost wages for employees injured on the job. | Required by state law in most states for businesses with employees. |

What’s Driving Up Insurance Costs in 2025?

During the insurance search, truckers should know about the big changes happening, particularly because fuel, maintenance, and driver wages are the top three expenses, and costs are rising in the trucking world in 2025:

- Costly collision claims and inflation are making insurance more expensive. Fleet owners need better plans to keep costs down. Because lawsuits over accidents are paying out huge amounts (over $10 million!), insurers are being forced to raise prices.

- Changes being talked about, like possibly raising the minimum liability coverage from $750,000 (which was set a long time ago) to $2 million, could really hit your budget.

- Many insurers now give discounts to fleets that use GPS and tracking systems to watch how drivers are doing, how much fuel they’re using, and how well they’re keeping up with maintenance.

- Newer trucks, like electric and hybrid models, have state-of-the-art technology and protective equipment that costs a lot to fix after a crash, so insurers are changing policies to cover the technology.

- FMCSA is watching insurance filings closely, often automatically, so there is no allowance for mistakes.

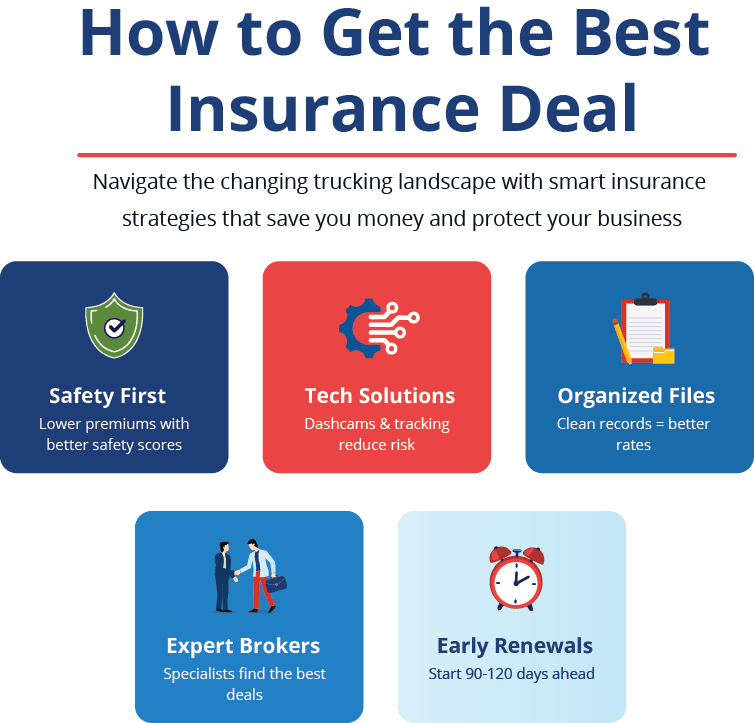

How to Get the Best Fleet Insurance Deal in 2025

The trucking world is changing, and here are some tips to get the best insurance deals:

- Put Safety First: Underwriters price policies depending on how risky they think you are. Your Out-of-Service (OOS) rates, driver records, and Safety Measurement System (SMS) scores matter a lot. If you do things like have drivers do safety training every few months and keep an eye on it, you might get a discount (like two to five percent off liability premiums).

- Employ Technological Solutions: Trucks with dashcams and tracking systems that watch all the time can lower your risk. Newer trucks with features like automatic braking often have lower insurance premiums.

- Keep Driver Files in Order: Sloppy driver files are a red flag for underwriters. Make sure all your training records and medical cards are up to date, get new driver records, and check your files before you ask for a renewal quote.

- Use a Broker Who Knows Trucking: A broker who specializes in trucking knows how to explain your company’s situation—like where you drive, what you haul, and what you’re doing to be safe—to insurance companies that focus on trucking.

- Start Early on Renewals: It’s best to start getting a renewal quote 90 to 120 days before your policy expires. That gives your broker time to find the best deal.

Fleet Insurance and Tax2efile: Protecting Your Trucks and Your Taxes

Insurance is a must-pay cost, and filing taxes is another area where truckers and fleet owners need simple, legal help. That’s where services like Tax2efile come in. They focus on one thing—the Heavy Highway Vehicle Use Tax (HVUT)—and make it easier to follow the rules and handle the paperwork. Fleet insurance protects truckers on the road, while Tax2efile simplifies compliance in the office. Truckers have a lot of paperwork, and missing deadlines can mean fines that eat into their earnings. Tax2efile simplifies the required e-filing of IRS Form 2290.

- If you have a heavy highway truck with a taxable gross weight of 55,000 pounds or more, you must file Form 2290. The annual tax payment is due on August 31st.

- The IRS sends you a stamped Schedule 1 after it receives your Form 2290. This is the official proof of payment and is needed by state DMVs to register or renew your heavy vehicle’s registration.

- Like fleet insurance, Tax2efile lets truckers file for several vehicles at once, which saves time and reduces stress. Truckers on the road can file taxes from anywhere at any time.

- Designed with truckers in mind, Tax2efile ensures compliance without extra overhead. They also help with importing data for fleets and with filings for changes in truck status (like credit claims for trucks sold or trucks that went over the low-mileage limit).

Fleet owners can get this tax thing out of the way by using Tax2efile to make the Form 2290 filing easier, which frees up time for important things like staying safe and getting smart insurance for 2025. By combining good fleet insurance with Tax2efile’s easy tax help, trucking companies can handle changing rules and costs. It’s important to protect your trucks, your future, your drivers, and your income. Fleet insurance protects your trucks on the road, while Tax2efile protects you from the IRS. Together, they give truckers the assurance they need to focus on their main job: hauling America’s goods.