- November 10, 2025

In the competitive business world, a few questions might confuse business owners on tax compliance, such as “Do S Corps Get 1099s?” The answer is “NO,” but there are some unknown exceptions that each S Corp owner must know. Understanding these rules is important to maintain IRS compliance and avoid penalties, which is where Tax2efile helps to make the process easier.

Table of Contents

What Is a 1099 Form, and Why Is It Needed?

Businesses and self-employed workers report their revenue using Form 1099, which is a component of the Internal Revenue Service’s (IRS) information reporting system. Apart from wages, salaries, and tips, which are reported on Form W-2, the form is mostly used to give the IRS information on income from sources unrelated to employment. This could encompass government payments, interest and dividends, earnings from freelancing, withdrawals from retirement accounts, etc. By ensuring that the right amount of tax is reported and paid, Form 1099 contributes to the transparency of an individual’s or business’s income.

When Does an S Corp Receive a 1099 Form?

According to IRS regulations, business owners running S Corps in consulting for specific payments made to corporations, including S Corporations, must report, and some of the notable exceptions are:

- If an S Corp offers any legal services, then it receives 1099-NEC forms from clients paying more than $600.

- Payments for medical services are reported on Form 1099-MISC.

- Other exceptions include the purchase of fish for resale and payments in exchange for profits (an uncommon practice for solopreneurs).

- If you are an attorney with an S Corp, then collect the required 1099s.

When S Corps Don’t Receive 1099?

When you select S Corp status, the IRS recognizes your business as a separate entity and changes everything on your taxes. The major advantages are.

- S Corps are not required to provide 1099-NEC forms for services. Your S Corp operates like other corporations, where clients just pay your company without the 1099 paperwork requirement. However, sole proprietors need to record every 1099 on their personal tax return.

- Your SSN will be replaced by all commercial transactions by your S Corp’s Employer Identification Number (EIN) to safeguard your SSN and set up a professional barrier; clients intend to send checks to “Your Business LLC” using your EIN rather than mailing them personally.

- Clients approach you differently when they consider you as a corporation with an EIN. You are no longer a freelancer; instead, you possess a company that can propose net-30 payment conditions, demand higher prices, and negotiate with contractors as equal partners.

- All customer payments go into your S Corp’s business account rather than gathering and processing more than ten distinct 1099s each tax season. One organization, one set of records, and one simplified system for all your earnings.

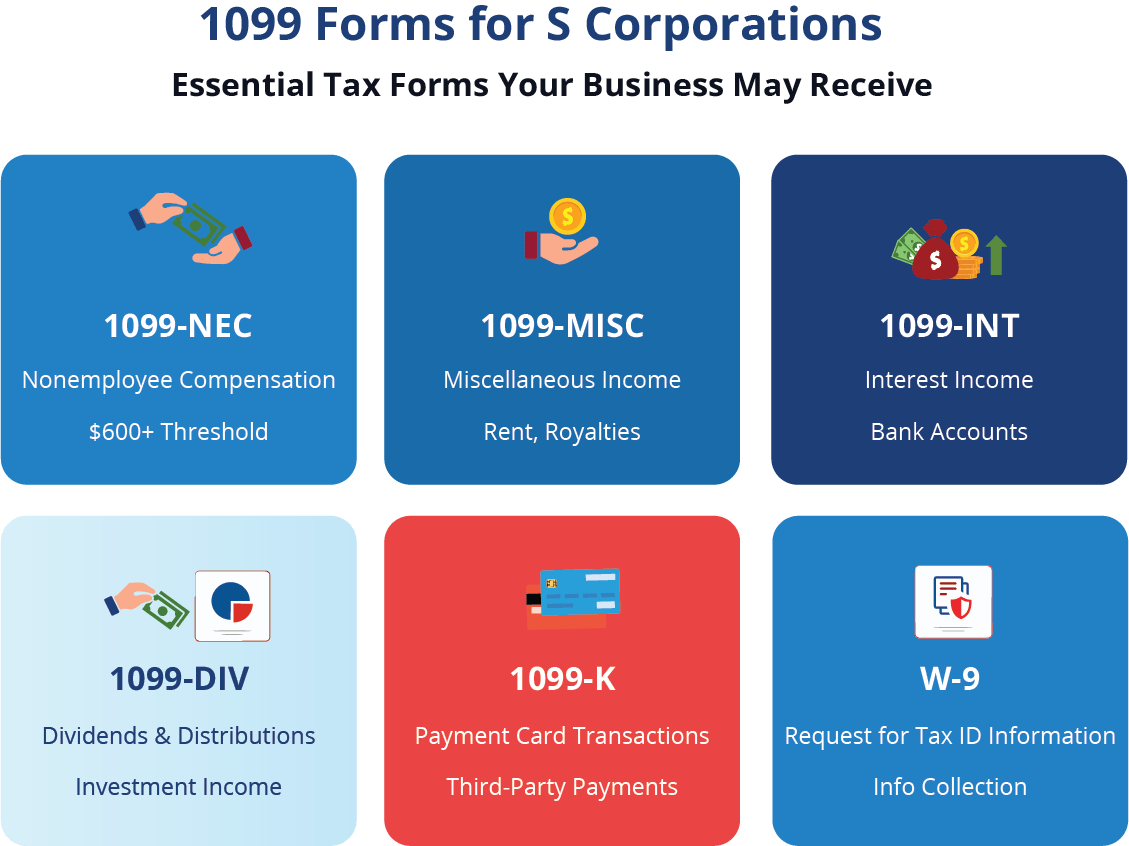

Typical 1099 Forms Received by an S Corp

In certain situations, the typical 1099 forms that an S Corp could receive are:

- Form 1099-NEC: You will receive this form from the payer only if you hire and pay a total more than $600 to the contractor during the year and describe the payment to the IRS.

- Form 1099-MISC: This form is received only if your S Corp obtains any miscellaneous income that doesn’t come under 1099 categories like rent, royalties, medical and healthcare, or other types of disparate income.

- Form 1099-INT: If your S Corp earns interest from bank accounts or financial assets, then the bank will provide you with Form 1099-INT to report the income received on interest.

- Form 1099-DIV: S Corps issues this form if you receive any dividend income.

- Form 1099-K: Issued for payment card or third-party network transactions by third-party payment processors (credit card networks) if your volume surpasses the reporting requirement.

- Form W-9: This form provides you with all the necessary information, like name, address, Taxpayer Identification Number, and tax classification, to know whether you require a 1099 or not.

How Do Organizations Submit S Corp 1099 Forms?

Steps involved in filing 1099 forms for an S Corp are:

- Finding the precise form types required based on the transaction is the basic step in filing a 1099 Form for an S Corporation. Form 1099-NEC should be provided, for instance, if an S corporation receives $600 or more for legal services or other non-employee payments.

- Get the information you need regarding the S corporation before submitting the 1099 form. This contains the address, federal tax classification, TIN, legal name, and other necessary details. Have the S corporation fill out Form W-9 if this information is not already on file. The precise data required for the 1099 file will be supplied by this form.

- Once the necessary data has been gathered, the next step is to fill out the relevant 1099 form. Both the S corporation’s details as the beneficiary and the payer’s company information should be entered. Depending on the type of 1099 form being utilized, the transaction amount should be recorded in the appropriate box. To avoid fines or delays, it is crucial to complete the form accurately.

- To prevent any fines for late or incorrect filings, the necessary 1099 form must be filled out and presented to the IRS before the relevant deadline. To prevent fines, it is crucial to make sure that all filings are completed to the IRS on time. Depending on how late the submission is, the IRS may charge penalties for late filing that range from $60 to $660 per form.

- Along with the form being filed with the IRS, the S corporation must receive a recipient copy of the 1099 form. The deadline for delivering this copy is January 31 of the subsequent year.

- It is crucial to keep precise records of all 1099 forms that are filed. The IRS may seek proof of filing in the event of inconsistencies or an audit; thus, copies of the submitted forms and proof of delivery should be kept for at least three years.

How Tax2efile Helps S Corps with 1099 Compliance

Tax2efile is an IRS-authorized e-file provider that issues ten or more information returns and simplifies 1099 filing for S Corporations, small businesses, and accounting professionals. The following steps show how Tax2efile helps you:

- Filing forms like 1099-NEC, 1099-MISC, 1099-INT, and more with instinctive online portals without any delays and paperwork.

- Directly transmits your form to both the IRS and state agencies to ensure compliance at all levels.

- To reduce rejection and penalties before submission, the system verifies the Taxpayer Identification Numbers (TINs) and scans for errors.

- Provides status notification, manages deadlines, and minimizes the risk.

- Excel uploads make it ideal for companies and tax preparers handling hundreds of forms or many clients.

By leveraging our efficient platform, your S Corp can streamline its outbound 1099 filing process, ensuring accuracy and compliance so you can focus on running your business. And when it is time to file, Tax2efile makes the entire 1099 process accurate, fast, and stress–free.