- December 3, 2025

Understanding IRS tax forms is essential for businesses that handle a wide range of transactions each month. Many businesses struggle to determine what to file, who receives which form, and how to remain compliant with the IRS. During tax season, Form 1099-MISC remains one of the most popular tax forms, yet it is misunderstood by many. Whether you are a business filing the form or an individual receiving it, understanding the thresholds and different scenarios makes your filing smooth and simple.

In this guide, we explain the Form 1099-MISC in an easy-to-understand and useful way. You’ll learn when it applies, the meaning of each reporting box, the data required by you, and the changes in the reporting rules from 2026 onwards. By the end, you should have a confident, structured approach to handling this important IRS form.

Table of Contents

What is Form 1099-MISC?

Form 1099-MISC is an IRS tax form used to report various types of income not covered by a traditional W-2 (wages, salaries, and tips) and paid under contract. It is used by businesses to report other incomes, such as rent paid, royalties, prizes, awards, crop insurance proceeds, medical payments, and certain types of attorney-related payments.

The Form 1099-MISC may be required for businesses that pay $600 or more for non-service income during the year. This form assists the IRS in confirming the income reported and ensures that the payer and recipient have correct tax reporting.

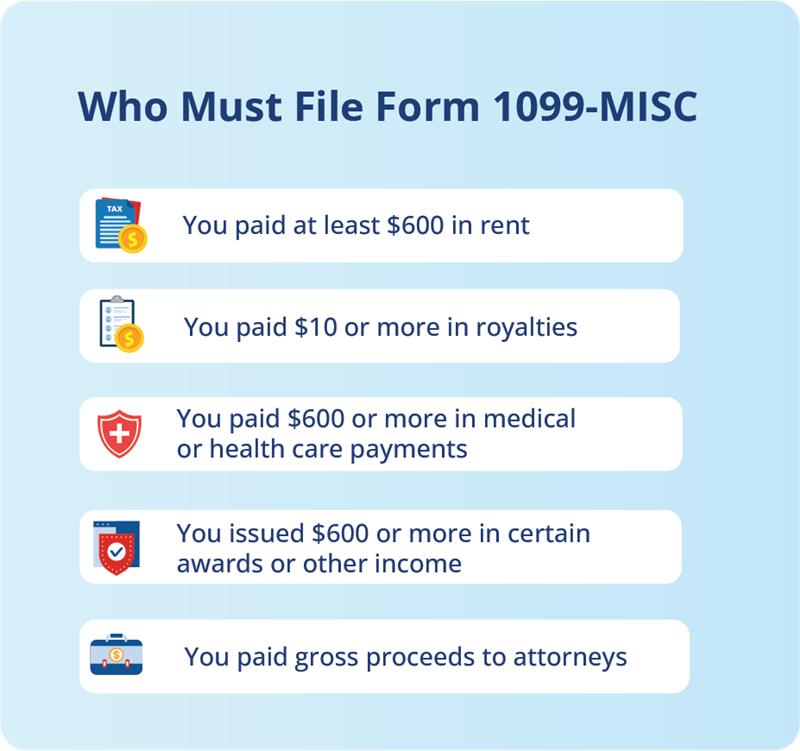

Who Must File Form 1099-MISC?

In general, individuals filing personal payments (rent) don’t need to file Form 1099-MISC. You need to file Form 1099-MISC if you’re a business, trade, or organization that made payments to an individual, partnership, or LLC. According to the IRS, Form 1099-MISC is submitted by:

- Businesses paid at least $600 or more for services to an individual within a calendar year for farming and fishing businesses, small business owners, office space, attorneys, and or equipment rentals to that payee.

- Royalties, which are payments to authors or inventors, must be paid at least $10.

- Paid $600 or more to doctors, clinics, or other health care services, even if the provider is incorporated.

Step-by-Step Guide to Filing Out Form 1099-MISC

Form 1099-MISC is partitioned into multiple sections. Copy A of Form 1099-MISC in red is intended for the IRS only. You can fill up the form’s black sections and send it to other recipients. Copy 1 sent to the recipient’s state tax department. Copy B is retained by the recipient. Copy 2 sent to the recipient’s state tax return. Copy C stays with the taxpayer. Before filing, identify the correct Form 1099-MISC, and you’ll need to collect some important information:

Payer Information: This section includes the name, address, and Taxpayer Identification Number (TIN), which can be either a Social Security Number (SSN) or an Employee Identification Number (EIN), and the information of the company or person issuing the form.

Recipient Information: The information of individuals or businesses receiving the payment must include their legal name, address, and TIN/SIN in this section.

Reporting the Income: Evaluate the total amount paid during the tax year through the values entered in the corresponding boxes. The table below elaborates on the specific types of income.

| Box | What It Reports | Filing Threshold | Examples |

|---|---|---|---|

| Box 1 | Rents | $600+ | Office rent, machinery leases, land rent |

| Box 2 | Royalties | $10+ | Mineral rights, book royalties, IP |

| Box 3 | Other Income | $600+ | Legal damages, grants, prizes, incentives |

| Box 4 | Federal Income Tax Withheld | N/A | Backup withholding |

| Box 5 | Fishing Boat Proceeds | N/A | Share of catch or FMV |

| Box 6 | Medical and Health Care Payments | $600 | Payments to medical or health care providers |

| Box 7 | Direct Sales of Consumer Products | N/A | Check if sales were $5,000+ for resale |

| Box 8 | Substitute Payments | $10 | Payments replacing dividends or interest |

| Box 9 | Crop Insurance Proceeds | $600 | Insurance payouts to farmers |

| Box 10 | Gross Proceeds Paid to Attorney | $600 | Legal service–related payments |

| Box 11 | Fishing Boat Owners | $600 | Fish purchased for resale |

| Box 12 | Section 409A Deferrals | N/A | Not required; see Notice 2008-115 |

| Box 13 | FATCA Filing Requirements | N/A | Check if reporting under IRC chapter 4 |

| Box 14 | Excess Golden Parachute Payments | N/A | Report excess parachute payments |

| Box 15 | Nonqualified Deferred Compensation | N/A | Income under section 409A |

| Box 16–17 | State Information | N/A | Used for state filings or combined programs |

Error Correction and Confirm Details: Recheck for amounts on 1099, names, addresses, and TINs, then compare the data on your form with official records like W-9. Each 1099 form includes instructions that detail any unique restrictions or exclusions. If you have questions regarding a specific box, refer to the IRS guidelines or a tax expert.

Distribute Copies and Submit via Mail or E-File: Send the recipient’s Copy B by January 31. File by February 28 for paper filing and by March 31 for e-filing with the IRS. If you’re mailing physical copies, attach Form 1096, which summarizes your 1099 filings for that year. Retain a copy of your records for future audit compliance. To reduce the risk and penalties and streamline the reporting, follow the IRS guidelines and each step carefully.

Example: ZenRise Consulting paid a landlord $16,000 in rent during 2024. Since the rent exceeds $600, ZenRise must file a 1099-MISC (Box 1). The consulting company filed taxes before the deadline. Suppose they sent Copy B on February 20 (20 days late), and the IRS is filed on time. The IRS charges for late recipient copies within 30 days, with a penalty of $60 per form. Hence, the recipient form was filled 30days late, with a penalty of $60 for one late 1099-MISC.

2025-26 Updates to 1099 Reporting Rules

Currently, businesses are required to send a 1099-MISC for payments over $600. However, starting in 2026, the threshold rises to $2,000, increased annually for inflation. Business owners should get ready for this shift by making sure accounting systems can monitor the new reporting requirements and thresholds.

Understanding Form 1099-MISC is essential for businesses committed to strong financial reporting and IRS compliance. While the form may appear intimidating at first glance, the process becomes manageable once you know which payments qualify, how the boxes work, and when filing is due. Businesses that maintain accurate financial records and use reliable e-filing solutions can significantly reduce errors, eliminate the risk of penalties, and simplify year-end processing.

Whether you are filing a single form or managing dozens of recipients, following IRS rules carefully and staying updated on threshold changes will keep your reporting accurate and stress-free. With a well-organized approach and the right filing tools, you can handle your 1099-MISC obligations confidently and efficiently.