- May 2, 2025

Taxpayers generally use IRS Form 2290 to figure and pay the taxes due on their highway motor vehicles. Taxes should be paid if the taxable gross weight of the vehicle is 55,000 pounds or more. This tax Form is also used to claim a credit for the taxes paid on vehicles that were destroyed, sold, or stolen. And on vehicles used for 5,000 miles or less. Let’s discuss what Form 2290 is, its importance in Oregon, and who needs to file this tax form.

Table of Contents

Form 2290 from Oregon

Form 2290 corresponds to the Heavy Vehicle Use Tax and is also applicable in the state of Oregon. It is the annual fee collected from heavy vehicles that operate on public highways and have a gross weight of 55,000 pounds or more. This Form is a critical component of maintaining the nation’s highways and transportation system. These HVUT taxes are imposed on the heavy vehicles that operate on public highways. Truckers in Oregon can either choose to e-file Form 2290 and get their Schedule 1 stamped from the IRS in minutes.

Purpose of the IRS Form 2290

The IRS Form 2290 is used to collect revenue for constructing and maintaining highways and other transportation infrastructure. This revenue, generated is typically used to fund the Highway Trust Fund. This, in turn, offers funding for developing highways and bridges. It is also used to construct transit projects across the United States.

Apart from funding the country’s transportation infrastructure, this tax, Form 2290, serves as a way for the IRS to track heavy highway vehicles in the state of Oregon. The IRS will also ensure compliance with federal tax laws through this Form. It requires the truck operators and owners to report and pay their federal excise taxes. The IRS will be able to monitor and regulate the use of such vehicles on public highways.

Get Started by Registering with Tax2efile Today!

Who uses Form 2290?

The IRS Form 2290, also known as the Heavy Highway Vehicle Use Tax Return, will be used by truck owners and operators. They will use this Form to report and pay their heavy vehicle use tax to the IRS. It is a tax applicable to heavy vehicles that run on publicly maintained highways. A vehicle is defined as having a gross weight of 55,000 pounds or more. HVUT plays an integral role in funding highway construction and maintenance projects.

The total weight of the vehicle, including the load it carries but excluding the trailers, is its taxable gross weight. This weight’s importance lies in determining the requirements for truck operators and owners to complete Form 2290 and pay the excise tax on their vehicles. Taxable gross weight denotes the weight of the vehicle loaded to capacity and prepared for use on public highways.

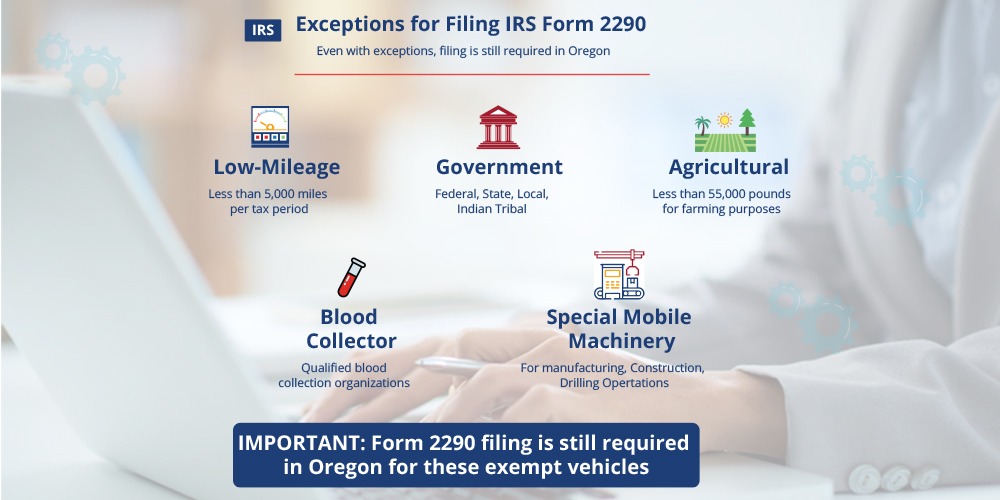

Exceptions for Filing IRS Form 2290

Most truck owners and operators are required to register their heavy highway vehicles on Form 2290 and pay their Federal excise taxes. Though there are a couple of exceptions to this rule, those exceptions would apply to Form 2290.

A very common exception to Form 2290 is:

- Low-Mileage Vehicle: A heavy motor vehicle with fewer than 5,000 miles of travel during the tax period will be treated as a low-mileage vehicle and will not be subject to federal excise tax.

- Government Vehicle: Vehicles owned and operated by the federal government, state governments, local governments, and Indian tribal governments are also exempt from federal excise taxes.

- Agricultural Vehicle: Vehicles meant for farming purposes with a gross weight of less than 55,000 pounds shall generally be considered to be exempted from paying federal excise taxes.

- Qualified blood collector vehicles: Blood collector vehicles operated by qualified blood collection organizations are also exempt from paying federal excise taxes.

- Special mobile machinery: This includes vehicles that cannot be loaded onto public highways for transport. They are used exclusively for specified purposes, such as manufacturing, construction, and drilling operations, and are exempt from paying federal excise taxes.

As mentioned earlier, with the exemptions, it is still required to file Form 2290 with the IRS for these vehicles in Oregon. The IRS will use these for purposes such as state vehicle registration or payment of certain state-specific taxes.

Vehicles that are Not Considered to be Highway Motor Vehicles

The following types of vehicles are not considered highway vehicles.

1. Mobile machinery that has been designed specially for non-transportation functions:

A self-propelled vehicle is not considered to be a highway vehicle if it satisfies the following conditions.

- The Chassis is mounted permanently to the equipment of machinery used to perform specific operations, such as manufacturing, drilling, mining, timbering, processing, and farming. Also, if the operation of the equipment or machinery is not related to transportation on or off public highways, it is not considered a heavy motor vehicle.

- The chassis has been designed specifically to serve as a mobile carriage and mount for machinery or equipment, whether it is in operation or not.

- The chassis couldn’t, due to its special design and without any structural modifications, be used as part of a vehicle designed to carry any other load.

2. Vehicles specially designed for off-highway transportation:

A vehicle has not been regarded as a highway vehicle if it is specially designed for the main purpose of moving goods from one point to another, apart from over public highways, and because of that special design, the vehicle’s capability to transport a load along a public highway is substantially inhibited or impaired.

IRS Tax Form 2290 for Oregon, and What Information Do the Individual Boxes Reveal?

The IRS Form 2290 is a crucial tax Form for truck owners and operators alike. To accurately report and pay the Federal excise tax on heavy highway vehicles, it is essential to understand the different boxes on the form.

Box 1: Enter the taxable gross weight of the vehicle and its trailers from July 1st of the past year till June 30 of the current year.

Box 2: Check whether you report the current tax period or an amended return.

Box 3: Enter the vehicle’s vehicle identification number. It is a 17-character alphanumeric code that is unique for each vehicle.

Box 4: Enter the name and address of the person or business that owns the vehicle. Box 5: Check whether the vehicle is used for agricultural purposes.

Box 6: Check the box if it is used as a logging vehicle

Box 7: Enter the miles that the vehicle is expected to travel during the tax period Box 8: Check whether you are filing as an individual or a business

Box 9: Enter the name and the address of the person to contact if the IRS has questions about the return.

Box 10: Enter the Electronic Filing Identification Number for tax professionals.

Box 11: Enter the federal excise tax due for the vehicle

Box 12: Enter the date the vehicle was first used on the public highway during the tax period.

It is mandatory for truck owners and operators to accurately report the taxable gross weight of their vehicles and pay the correct value of the federal excise tax. Also, failing to file or pay taxes on time can result in penalties and interest charges. Partnering with an IRS-authorized tax filing agency like Tax2efile helps ease the stress of filing and paying HVUT taxes in Oregon before the deadline.

Get Started by Registering with Tax2efile Today!