- June 9, 2025

Owners and operators of heavy trucks that weigh 55,000 pounds or more should use Form 2290. This IRS tax Form is a critical component of maintaining the nation’s highways and transportation systems. This federal tax Form is used to report and pay the heavy vehicle use tax to the Internal Revenue Service. This tax will be imposed on heavy vehicles operating on public highways with a gross weight of 55,000 pounds or more. This tax Form funds the highway construction and maintenance projects all over the country.

Table of Contents

Purpose of IRS HVUT 2290 Form

The main purpose of the IRS HVUT 2290 Form is to collect revenue that will be used for constructing and maintaining highways and other transportation infrastructure. The amount generated from this federal excise tax on heavy highway vehicles will go towards funding the Highway Trust Fund, which will, in turn, provide money to carry out bridge and highway construction and maintenance projects, as well as transit service projects, throughout the United States.

Form 2290 is used to raise revenue from the transportation sector to fund the infrastructure that the sector uses. The IRS intends to use the information on Form 2290 and any returns to track heavy vehicles and establish the tax compliance of vehicle owners under federal tax laws. Thus, the IRS could monitor and regulate the use of heavy public road vehicles by requiring truck owners and operators to report and pay the federal excise tax.

Uses of Form 2290, Heavy Highway Vehicle Use Tax Return

Taxpayers can use IRS Form 2290 to figure and pay the tax due on highway motor vehicles used during the tax period with a taxable gross weight of 55,000 pounds or more. They can also use this form to figure out and pay the taxes due on a vehicle for which they have completed the suspension statement on another Form 2290 if the vehicle was later exceeded the mileage use limit during the tax period.

Form 2290 can be used to figure and pay the tax due during the tax period, the taxable gross weight of a vehicle increases and the vehicle falls into a new category. The Form can also be used to claim a suspension of tax when a vehicle is expected to be used for 5,000 miles or less. This limit is 7500 miles or less for agricultural vehicles during the tax period.

They can also claim a credit for the tax paid on vehicles that were destroyed, sold, stolen, or used for 5,000 miles or less. The tax Form 2290 can be used to report the acquisition of a used taxable vehicle for which the tax has been suspended. This Form is also used to figure and pay the tax due on a used taxable vehicle that is acquired and used during the tax period.

Tax professionals who work with trucking companies and individual trucking contractors may also use Form 2290 to help their clients meet their tax obligations. Tax professionals might offer guidance and advice on the tax requirements for heavy highway vehicles and help their clients file Form 2290 accurately and on time.

State and federal agencies that regulate the transportation industry may use Form 2290 to monitor compliance with federal tax laws. These agencies can use the information provided on Form 2290 to ensure that truck owners and operators are paying the appropriate federal excise tax and meeting their tax obligations.

Taxable Gross Weight of the Vehicles and Exceptions

Taxable gross weight is the entire weight of the vehicle, all loads inclusive, and does not include the weight of trailers. This will determine whether the truck owner and operator should file Form 2290 for the Federal excise tax levy applicable to vehicles weighing more than 55,000 pounds. Taxable gross weight is also defined as the weight of the vehicle while carrying a full load, and when the vehicle is used on the public highways fully loaded and ready for use.

The taxable gross weight is important when filing Form 2290. Truck-based businesses would have to report their taxable gross weight accurately to pay the correct federal excise tax amount. In addition, interest charges and penalties will be incurred if tax is not filed or paid on time.

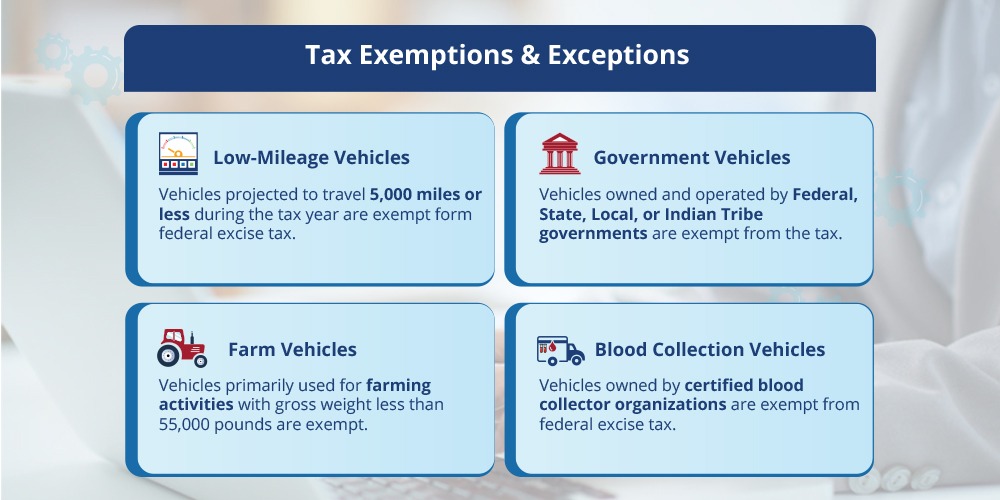

There are some exceptions to filing the massive federal excise tax on highway motor vehicles, commonly known to truck owners and operators, such as those listed below.

- A vehicle that is projected to run not more than 5000 miles during the year is what is known as a low-mileage vehicle, and by being in this category, does not have to pay the federal excise tax.

- Vehicles, that are owned and operated by the Federal Government or state governments, local governments, and Indian tribe governments, are exempted from the federal excise tax.

- Exceptions to federal excise taxes apply to vehicles primarily used for farm activities and have a gross weight of less than 55,000 pounds.

- Blood collection vehicles owned by certified blood collector organizations are also tax-exempt.

Why is Form 2290 Compliance Important for Truck Registration?

Form 2290 is required for the initial registration of a truck. If a trucker is registering a new heavy-duty vehicle, most states require Form 2290 Schedule 1 to be used as part of the documentation process. If there is no proof of HVUT payments, the state transportation authority will not offer the truck’s registration. Also, if the truck is registered, renewing the registration is a requirement for an updated Schedule 1, which is based on the recent HVUT file period.

For trucks that operate within state lines, as part of the International Registration Plan, proof of HVUT payment is mandatory. The majority of state IRP offices will not process renewal requests without an up-to-date Form 2290 Schedule 1. Also, failure to submit Form 2290 on time could result in IRS penalties and interest fees. Operating a vehicle without proper registration, due to non-compliance with the law, may lead to penalties and impoundment of the vehicle.

E-filing IRS tax Form 2290 with Tax2efile

Collect all pertinent information prior to filing IRS Form 2290, including Employer Identification Number (EIN) and Vehicle Identification Number (VIN) for every vehicle. Taxable gross weight should also be computed for each vehicle.

The second important factor is the method of filing. The taxpayer has to decide whether to file Form 2290 electronically or on paper. Filing Form 2290 electronically is much more convenient and faster. If a return is filed on paper, it must be mailed to the proper IRS address.

Checklist one on the tax form includes basic information such as business name, business address, and EIN. The second checklist will require you to enter your vehicle’s VIN and the taxable gross weight of the truck. The taxpayer must check the appropriate boxes in Part III if the vehicle is used solely for agricultural purposes, if tax is suspended for less than 5,000 miles on the vehicle, or if the vehicle was sold or damaged during the tax period. Part IV must compute the tax due based on the taxable gross weight of all vehicles. In Part V, the taxpayer should sign and date the form to certify that the information provided is true and correct.

Once these steps and the form are completed properly, we can ensure that your Form 2290 is filed correctly, thus avoiding penalties and delays.

In order to stay compliant, truck owners should file the HVUT 2290 tax Form well before the deadline. E-filing the Form through Tax2efile is the most viable option, and they help with the quick and immediate approval of Schedule 1, as well as staying compliant with the taxation department.